Boccard offers an array of discretionary and non-discretionary asset management solutions designed for a diverse range of objectives and risk profiles.

Our Portfolio Managers employ a proprietary hybrid strategy which combines rigorous data-driven research with local insights and context, informed by our highly experienced Asset Management team headed by the Chief Investment Officer.

Clients can monitor the performance of their portfolio over time through our client portal as well as our monthly summaries.

Boccard does not sponsor or underwrite its own financial products or funds. As such, clients are assured that our professionals will be completely independent.

While every financial firm claims to have their clients’ best interests in mind, we have put in place a structure that fully aligns our incentives with yours. We believe this is the only way to guarantee that there will not be any conflicts of interest.

Fixed

Income

Our strategies seek to deliver consistent risk-adjusted returns while also managing and mitigating volatility.

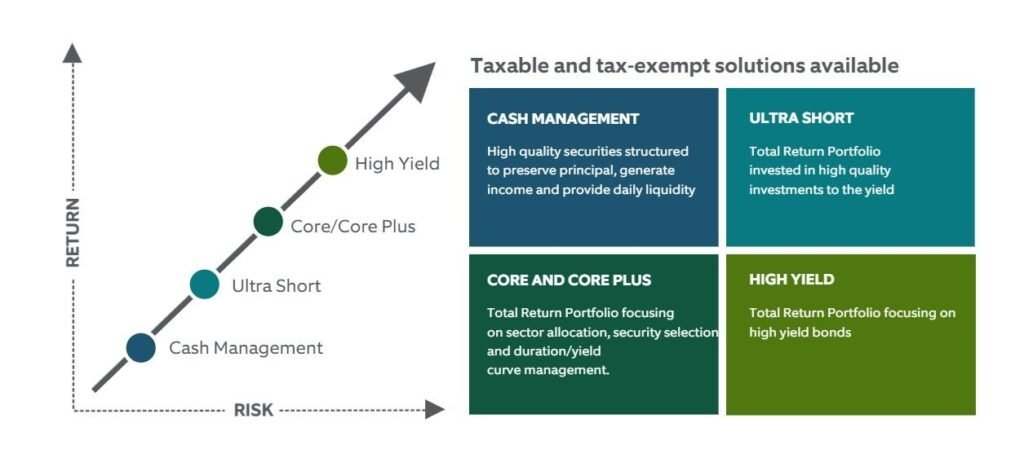

At Boccard, we practice active fixed income investing which prioritizes preservation of capital and income generation, for both taxable and tax-exempt investors. Our investment process is informed by a rigorous foundational approach that emphasizes both fundamental credit research and macroeconomic strategy.

Our Portfolio Managers seek to add value across interest rate duration, yield curve, sector allocation, security selection, country and currency strategies. Our well-diversified strategies target consistent risk-adjusted returns and low levels of volatility, amidst a dynamic rate and credit environment.

Equities

We build portfolios using a rigorous approach that cost-effectively targets persistent sources of excess returns while seeking to control for unintended risks.

Our Portfolio Managers approach equity and index markets with the objective of delivering consistent risk-adjusted returns over the long-run. This starts with targeting systematic sources of excess return that have been proven over long periods.

Then, we apply a proprietary quality factor – meaning that we select securities based on objectively strong company fundamentals – which has been proven to improve risk-adjusted returns.

Historically, a substantial proportion of our returns have come from securities in emerging and frontier markets. In such markets, we take into account local insights and contextual information provided by our trusted partners with whom we have cultivated strong and trusted relationships over many decades.

Alternatives

At Boccard, we take the view that Alternative Assets should be a component of every balanced investment portfolio because of their potential to deliver asymmetric, outsized returns.

Our Alternative Assets team is active in private equity, private debt, venture capital, real estate and fine art, and invests substantial time, energy and resources in cultivating a global network of strategic relationships which are able to present access-restricted opportunities usually monopolized by specialized mega-funds and large institutions.

While such assets are usually risky and illiquid, they have the ability to deliver supernormal returns within an accelerated time frame. Clients are also invited to participate in periodic strategy and information calls so that they can establish familiarity with whichever of these asset classes interest them personally.